The importance of analytics for sales organizations is clear and, as I pointed out in my recent analyst perspective on the next generation of sales analytics, these capabilities optimize revenue potential. However, utilizing sales analytics requires a set of data skills that most organizations still find challenging and are thus not fully prepared to support. The efficient access and preparation of data underlies any analytics processes, which must meet demanding needs that are not always automated. Our research into next generation sales analytics has found many impediments that must be addressed and is a critical part of our expertise agenda for sales organizations.

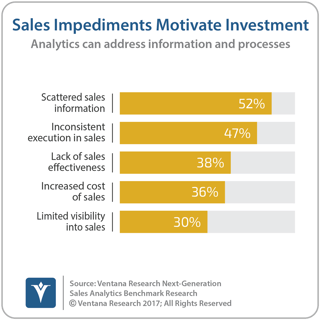

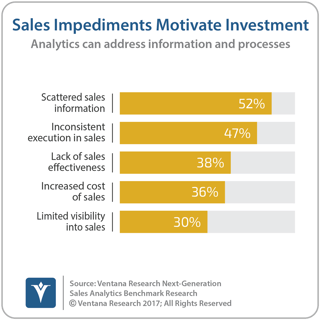

Organizations’ most common complaints are that the sales process is too slow (53%) and that data is not readily available (51%) or accurate (43%). More than half (52%) of companies cited scattered sales information as an impediment to sales. These sorts of issues limit the accuracy and completeness of the conclusions that analytics generate.

impediment to sales. These sorts of issues limit the accuracy and completeness of the conclusions that analytics generate.

Regarding the speed of the process, only about one-third (35%) said they can calculate and use sales analytics within one day, while almost one-fourth (24%) of organizations reported that it takes a month or more; 17 percent require one to four weeks. Clearly, a few weeks is too long; there is no reason that alignment of sales data can’t be done daily using data-related technologies that automate preparation and integration.

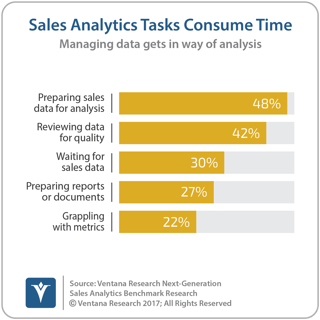

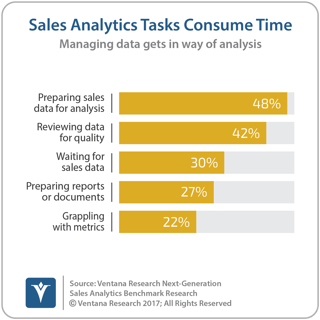

Data preparation and overall management is a precursor to effective analytics, and our research finds that organizations encounter a variety of problems in data preparation. Almost half of organizations reported that employees spend most of their time doing sales analytics preparing the data for analysis (48%), with nearly as much time spent reviewing  data for quality and consistency issues. Fewer than half of that said they spend the largest portion of their time on actual analysis – for example, trying to determine root causes (21%) or how changes impact current business (20%).

data for quality and consistency issues. Fewer than half of that said they spend the largest portion of their time on actual analysis – for example, trying to determine root causes (21%) or how changes impact current business (20%).

Data quality is especially troublesome for very large organizations (those with more than 10,000 employees), which likely have more sales-related data than smaller ones; three-fourths (74%) of these organizations said data is not readily available. Overall, only 3 percent of organizations said they are very confident in the quality of information generated by their sales analytics process. Additionally, more than one-third (36%) of participants said the technology they use in their sales analytics process is inadequate and only 28 percent said they are satisfied with their current sales analytics software. Another research finding helps explain these results: the software most commonly used for sales analytics, by 36 percent of organizations, is a sales force automation (SFA) or customer relationship management (CRM) system, neither of which is designed for the complexities of contemporary sales analytics. A dedicated sales analytics environment is far more effective in providing critical time- and change-related analytics that compare and calculate a range of account and pipeline related metrics. Today’s SFA and CRM tools are simply not able to provide this capability.

Only 6 percent of participating organizations use more effective dedicated sales analytics tools or sales applications; these tools are found most frequently in finance, insurance and real estate (77%) and services (60%) companies. Yet despite the rather low levels of satisfaction with current sales analytics, only 5 percent of participants said they plan to change software vendors, with almost one-fourth (24%) considering a change; this suggests not enough organizations are taking steps to improve sales analytics.

When we turn to those organizations considering further investment in sales analytics, we find them driven to do so by a variety of issues. As noted above, scattered sales information was the most cited motive, followed by three other problems that impact business performance: inconsistent execution in sales, lack of sales effectiveness and increased costs of sales. Each of these issues is significant enough that organizations indeed may feel it necessary to acquire better tools for data preparation and integration across data sources, perhaps dispersed across on-premises and cloud computing systems.

To support the next generation of sales analytics, you should assess data-related processes and tasks that currently support your efforts. A first step would be to examine if the analytics in place are comprehensive enough and if they use the scope of the data needed. If not, then look to determine if the analytics tools used for sales have the data-related support that can provide metrics efficiently and at the frequency needed, which for many organizations is moving to a weekly and, in some cases, a daily basis. Adopt the methods and tools that can help your organization prepare and wrangle the data to the format and needs of the sales process and analytics requirements.

Regards,

Mark Smith

CEO and Chief Research Officer

Follow Me on Twitter and Connect with me on LinkedIn.