I have been following advances in sales analytics since the 1990s. Over the last five years, however, I have seen evolution, not innovation. In most cases the information that analytics provides is too complicated and not contextualized enough for sales people who are not analytics experts to understand, let alone take action on. As I pointed out in my 2017 research agenda on sales, analytics is essential for planning that improves the impacts of sales efforts and meets the goals of the organization.

Too often organizations depend on reports from their sales force automation and CRM tools that focus on the past and do not look to the future, or on charts that do not explain information or provide suggestions for improving results. Analytics has great potential to provide insights on sales processes, yet many sales organizations and operations teams are missing out on the improvements analytics can deliver. We conducted benchmark research in next generation of sales analytics to investigate the state of the industry and best practices that organizations can use to improve.

Effective analytics enables businesses to understand the data they’re collecting in greater volumes and more forms than ever before, and these new capabilities are especially relevant to sales organizations. When applied to sales data, analytics can help sales teams achieve quotas and forecast more consistently, as well as understand the impact of incentives and maximize the potential of territories, all of which help optimize sales performance. These benefits establish the foundation for a business case to adopt analytics tools that generate information to guide actions and decision-making for sales organizations.

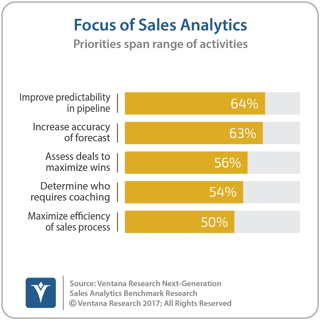

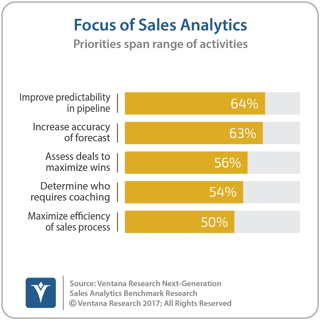

According to our benchmark research, three in five (58%) organizations said sales analytics is very important to the success of their sales efforts. They most often apply analytics to improve predictability in the sales pipeline, increase the accuracy of the sales forecast and assess sales deals to maximize win potential and minimize missed opportunities. Organizations most often measure overall sales performance by assessing customer revenue (57%), revenue attainment (54%) and quota attainment (51%). Fewer companies measure forecast accuracy (36%) or customer satisfaction (31%), though these also are essential to sales performance.

(58%) organizations said sales analytics is very important to the success of their sales efforts. They most often apply analytics to improve predictability in the sales pipeline, increase the accuracy of the sales forecast and assess sales deals to maximize win potential and minimize missed opportunities. Organizations most often measure overall sales performance by assessing customer revenue (57%), revenue attainment (54%) and quota attainment (51%). Fewer companies measure forecast accuracy (36%) or customer satisfaction (31%), though these also are essential to sales performance.

However, with so many technological advances to assess, selecting the right tools for analytics can be difficult. Moreover, people charged with that responsibility often don’t understand the best uses of sales analytics or the scope of various user requirements. Ventana Research undertook this benchmark research to determine the attitudes, requirements and future plans of those who use sales analytics technologies and processes and to identify the best practices of organizations that perform well in it. We set out to examine both the commonalities and the qualities specific to major industry sectors and across sizes of organizations. We considered how organizations manage sales analytics, issues they encounter in the process and how their use of it and related technology are evolving.

It is clear that organizations take sales analytics seriously, but the research also shows that most do not execute it especially well. More than half (55%) of participants said they are not satisfied with the current process their sales organization uses to calculate analytics; only 30 percent reported that they are satisfied. Our Performance Index, which in this case assesses the readiness of sales organizations to use analytics, ranks the majority (59%) of organizations at the two lowest levels of our four-tiered performance hierarchy. Among the four business dimensions into which we segment performance, the analysis reveals that organizations most often need to improve in the two more technical dimensions, Information and Technology.

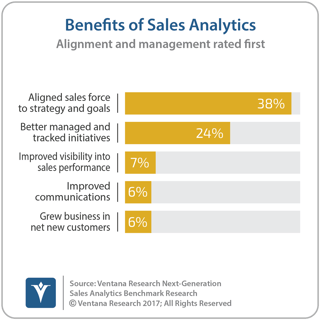

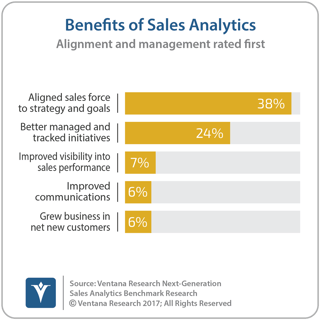

Elsewhere the research indicates that organizations’  use of sales analytics capabilities enables them to achieve useful results. The benefit most often ranked first is the capacity to align the sales force to business strategy and goals (by 38%), followed by better managing and tracking the progress of product and sales initiatives (ranked first or second for 40%). In addition, organizations that have adopted dedicated sales analytics tools or sales applications said that using them has improved the outcomes of their sales activities and processes significantly (20%) or slightly (47%). We find higher percentages of significant improvement in large organizations as measured by the number of employees (41%) and companies in finance, insurance and real estate (58%).

use of sales analytics capabilities enables them to achieve useful results. The benefit most often ranked first is the capacity to align the sales force to business strategy and goals (by 38%), followed by better managing and tracking the progress of product and sales initiatives (ranked first or second for 40%). In addition, organizations that have adopted dedicated sales analytics tools or sales applications said that using them has improved the outcomes of their sales activities and processes significantly (20%) or slightly (47%). We find higher percentages of significant improvement in large organizations as measured by the number of employees (41%) and companies in finance, insurance and real estate (58%).

Of course, the impact of sales analytics depends on people within the sales organization to use the information analytics renders to their advantage. This means analyzing not only the pipeline, quotas and territories but also the performance of people in the sales organization and ways to help them be more successful. Utilizing analytics means a team is selling to its potential, seizing the opportunity to optimize results by establishing key sales indicators that span the people and processes of sales organizations. This might seem obvious, but often sales analytics has been relegated to an analytic dashboard with a set of charts that look great but are not actionable until they are translated into prescriptive guidance.

For next steps we advise organizations to assess their current efforts and determine where to improve their sales analytics, keeping in mind that this is a continuous optimization journey that should never be static.

Regards,

Mark Smith

CEO and Chief Research Officer

Follow Me on Twitter and Connect with me on LinkedIn.