It should be no surprise for those who work in sales that increasing outcomes collectively is not always easy. Sales teams and individuals work under pressure to perform at high levels, selling more than they did in the previous period or more than the person who previously had responsibility for a territory. Today’s economic and competitive environments demand that everyone work not just faster but smarter in their sales efforts. To excel in this environment requires not just wise use of time but prioritization of the activities and tasks that contribute to achieving the quota and forecast. In the past, sales organizations often resisted adopting new technology, but it’s time for them to realize that tools are available to facilitate better sales performance. As I outlined in the overview of our business and technology research agenda for this year, the sales department has a ripe opportunity to get smarter in how it operates. This is the essential point of our research practice in sales applications and technology: Our methodical benchmark research examines applications and technology best practices and benefits for sales organizations, and we assess the vendors and products in this market through our Value Index ratings. We will start 2014 with the latest release of our Value Index on Sales Performance Management, which will help sales management evaluate products to assist in improving performance of the organization.

selling more than they did in the previous period or more than the person who previously had responsibility for a territory. Today’s economic and competitive environments demand that everyone work not just faster but smarter in their sales efforts. To excel in this environment requires not just wise use of time but prioritization of the activities and tasks that contribute to achieving the quota and forecast. In the past, sales organizations often resisted adopting new technology, but it’s time for them to realize that tools are available to facilitate better sales performance. As I outlined in the overview of our business and technology research agenda for this year, the sales department has a ripe opportunity to get smarter in how it operates. This is the essential point of our research practice in sales applications and technology: Our methodical benchmark research examines applications and technology best practices and benefits for sales organizations, and we assess the vendors and products in this market through our Value Index ratings. We will start 2014 with the latest release of our Value Index on Sales Performance Management, which will help sales management evaluate products to assist in improving performance of the organization.

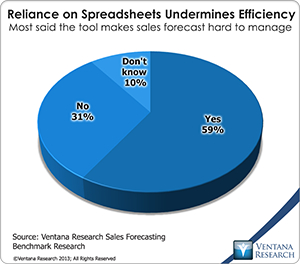

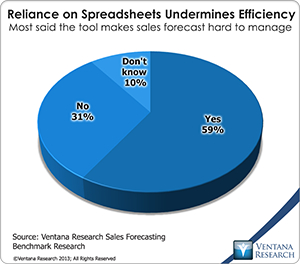

Technology advances in sales applications and technology in the last several years have given those who use them an advantage.  For example, mobile technology enables sales organizations to quickly access metrics from sales analytics; these can be shared to help the whole team meet their objectives. But these improvements first require willingness to change, to go beyond the conventional wisdom of using sales force automation (SFA) for more than defining and tracking accounts, contacts and opportunities. Those who continue to use spreadsheets to manage sales performance will be even less efficient and fall further behind those who use more capable tools. Our latest benchmark research in sales forecasting shows that more than half (59%) still use spreadsheets to manage sales forecasts; doing so wastes time and prevents immediate access to critical information. It also finds that the process is not reliable and data is not accurate in more than half of organizations.

For example, mobile technology enables sales organizations to quickly access metrics from sales analytics; these can be shared to help the whole team meet their objectives. But these improvements first require willingness to change, to go beyond the conventional wisdom of using sales force automation (SFA) for more than defining and tracking accounts, contacts and opportunities. Those who continue to use spreadsheets to manage sales performance will be even less efficient and fall further behind those who use more capable tools. Our latest benchmark research in sales forecasting shows that more than half (59%) still use spreadsheets to manage sales forecasts; doing so wastes time and prevents immediate access to critical information. It also finds that the process is not reliable and data is not accurate in more than half of organizations.

The imperative to provide the best possible customer experience, which my colleague Richard Snow outlines in his customer engagement agenda, indirectly impacts sales. Both require high-quality and relevant product information whether it comes from sales interactions, e-commerce or websites. Both customer service and sales can benefit from the organization creating a single repository of all product information managed centrally. Tools for product information management (PIM) utilize master data management methods that enable product teams in businesses to define, administer and publish this critical information to those who need it, including Sales. Our research shows that the use of dedicated PIM technology has helped almost half (47%) of organizations eliminate errors and mistakes and that 90 percent of those that use a single system gain competitive advantage through faster time to market. This year a significant transformation of where PIM and commerce software will converge further to help provide the information in the shape and form required even as it is required across smartphones and tablets. Our new Value Index on Product Information Management for 2014 will assess progress of vendors and their investments in products to help you determine which ones can best meet your needs.

Just as quality information is critical, so is the ability to use analytics to build metrics that can provide immediate visibility into the progress of sales. Depending on periodic reports and dashboards doesn’t work in the accelerated pace of business today. Mature organizations are using predictive analytics and data mining of big data repositories to extract previously inaccessible insights; this can be critical for large sales organizations that sell large volumes of products. We will assess the advances in sales analytics in a new benchmark to determine how they have facilitated change in sales operations and increased efficiency in their processes. We already found in 2013 through our benchmark research in location analytics are helping provide a competitive edge on the ability to sell effectively in a territory but also how they are designed and optimized to achieve specific quotas. A new generation of sales analytics are advancing and accessible through mobile technology. In addition our 2014 Value Index in Mobile Business Intelligence assessed 16 vendors of business intelligence tools on their ability to provide best in class accessibility through across smartphones and tablets.

These advances and others provide for sales organizations a variety of applications and tools that can be used by sales executives, management, operations managers and account representatives. Sales organizations also need improvement in other areas including learning and coaching, compensation and incentives, forecasting, setting objectives, activity tracking, recognition and rewards. In 2014 we will conduct new research on next-generation technologies such as social collaboration for coaching and improving skills and on mobile devices to track and assess sales efforts. Better use of coaching and playbooks can help everyone in sales find and apply best practices or the right sales assets to use in communicating with prospects. On another front, industry pundits and vendors are buzzing about gamification in motivating sales, this is nothing new, and there are practical ways of having contests and leader boards for the sales team or individual quotas.

Our new benchmark research coming out in 2014 examines the automation of compensation plans and incentives for sales. New  tools make them readily accessible at any time to help sales reps and managers determine progress toward targets; these offer an automated way to escape the silos of spreadsheets and documents. We will also assess the state of vendors and products in the Value Index for Sales Compensation in 2014. In a related area it is also critical to optimize the effectiveness of sales quotas and align them to territory management, which can help maximize the potential of sales organizations. Also marketing and sales can align their efforts through use of demand generation to ensure the tracking of inbound and outbound marketing feeds into business processes through nurturing of dialogue and interactions. And in 2013 we saw significant improvement to integrate configuration, pricing and quote (CPQ) management into the deal process and the SFA aspects of opportunities.

tools make them readily accessible at any time to help sales reps and managers determine progress toward targets; these offer an automated way to escape the silos of spreadsheets and documents. We will also assess the state of vendors and products in the Value Index for Sales Compensation in 2014. In a related area it is also critical to optimize the effectiveness of sales quotas and align them to territory management, which can help maximize the potential of sales organizations. Also marketing and sales can align their efforts through use of demand generation to ensure the tracking of inbound and outbound marketing feeds into business processes through nurturing of dialogue and interactions. And in 2013 we saw significant improvement to integrate configuration, pricing and quote (CPQ) management into the deal process and the SFA aspects of opportunities.

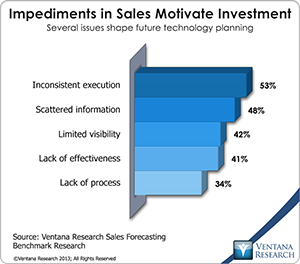

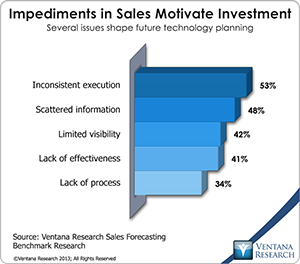

I’ll say again that all of this change means we cannot depend on conventional wisdom that says you can just use SFA and personal productivity tools to understand and improve sales performance. Our research has found that impediments such as inconsistent execution (53%), scattered information (48%) and limited visibility (42%) are motivating technology investments. Analytics help to develop metrics for performance and planning, and the use of big data to mine and harvest information assets, can help. Moving to applications that automate interaction among sales teams can help achieve a common set of goals.

Our benchmark research in various aspects of sales continues to find significant opportunities for organizational improvement through better tools. Applications are easier to access and use from the cloud or on mobile technology. Dedicated software can help interconnect sales with the other lines of business. For example, a dedicated approach to sales and operations planning can help ensure that the forecast and planning process connects sales, operations and finance. In the area of talent management that my colleague covers that can enhance the range of key employees activities for sales including recruiting, onboarding to learning, performance and career planning, which can be done more effectively through collaboration between sales and HR. Many providers of sales applications are beginning to advance in this area to directly help sales be as efficient as possible.

find significant opportunities for organizational improvement through better tools. Applications are easier to access and use from the cloud or on mobile technology. Dedicated software can help interconnect sales with the other lines of business. For example, a dedicated approach to sales and operations planning can help ensure that the forecast and planning process connects sales, operations and finance. In the area of talent management that my colleague covers that can enhance the range of key employees activities for sales including recruiting, onboarding to learning, performance and career planning, which can be done more effectively through collaboration between sales and HR. Many providers of sales applications are beginning to advance in this area to directly help sales be as efficient as possible.

Making sales people and processes more efficient and effective in using technology built for its particular purposes is critical to ensure the best outcomes. Sales will need to think beyond conventional wisdom and examine what is needed to be effective from sales management, manager and operations but also down to how help every account manager be as efficient as possible. Sales should also explore building alliances with finance and IT to see where faster investments can accelerate the potential to achieve the sales targets and revenue expectations of the organization. Use our sales-related research and assessments of applications and technology across vendors to learn where your opportunities may lie.

Regards,

Mark Smith

CEO & Chief Research Officer

find significant opportunities for organizational improvement through better tools. Applications are easier to access and use from the cloud or on mobile technology. Dedicated software can help interconnect sales with the other lines of business. For example, a dedicated approach to sales and operations planning can help ensure that the forecast and planning process connects sales, operations and finance. In the area of talent management

find significant opportunities for organizational improvement through better tools. Applications are easier to access and use from the cloud or on mobile technology. Dedicated software can help interconnect sales with the other lines of business. For example, a dedicated approach to sales and operations planning can help ensure that the forecast and planning process connects sales, operations and finance. In the area of talent management