All lines of business are under pressure to meet targets and deliver expected results, but none is under more pressure than Sales. Like other organizations it must use information to derive insights about progress and problems and to decide what changes to make. Today businesses collect and analyze data from more data sources in more forms than ever before. To understand it they need effective analytics, and again none need it more than Sales.

Analytics applied to sales data can deliver significant value.  It can help sales organizations reach quotas, forecast more accurately and make better decisions about activities and strategy. However, selecting the right tools for analytics can be difficult. People charged with identifying those tools often don’t understand the specific needs of sales groups or the full scope of evaluation criteria required for successful deployment and use.

It can help sales organizations reach quotas, forecast more accurately and make better decisions about activities and strategy. However, selecting the right tools for analytics can be difficult. People charged with identifying those tools often don’t understand the specific needs of sales groups or the full scope of evaluation criteria required for successful deployment and use.

In the past, and often still today, many sales organizations did not invest directly in analytics, instead using desktop spreadsheets, cutting data and charts from applications and reports and pasting it into presentations. In addition organizations have tried to stretch applications designed for other purposes, such as sales force automation (SFA) and customer relationship management (CRM), to provide reports on accounts and opportunities, but these systems address only some sales activities and lack complete information about customers. They need more purpose-built tools to examine sales performance in core processes such as the sales pipeline, forecasts, configuration pricing and quoting, proposals, quotas, compensation and incentives, and coaching of personnel. Used properly analytics can provide insights on all of these. But to select tools that cover all these areas, prospective users of sales analytics must be able to understand the available options and identify the capabilities that will serve them best. Should they be simple or complex? One-time or continuously used? Historical or forward-looking? In addition the tools should be easy to use and able to make data readily available. Several of our benchmark research studies demonstrate the need for effective analytics in this critical business area of sales.

The expanding use of sales analytics stems from increased attention to performance across sales processes (particularly because of the importance of sales in revenue and financial planning to meet customer demand with products and services). In sales planning, the need for quick analysis and review of actuals vs. plan is the management capability most often important (for 73%) for organizations participating in our next-generation business planning benchmark research. Many sales initiatives have failed to live up to their potential because companies did not use the right analytics tools and approaches to plan and operate them. For example, measuring the wrong things, measuring the right things the wrong way or using only partial data to measure will have negative (and often unintended) consequences. That’s because sales decisions almost always must be made in a constrained environment, in which virtually every important decision requires trade-offs (such as price against volume). To be useful, analytics must recognize trade-offs and provide guidance to help decision-makers choose those that are aligned not only with the company’s overall objectives but also with its customer, financial and sales profitability goals. Sales analytics also can support new approaches such as sales contests and gamification that motivate employees to perform better.

Analytics also is a key tool for devising, tracking and revising measures and metrics for sales processes that enable managers to make better-informed decisions faster and more consistently. Sales operations managers and executives need advice on selecting the analytics most useful for them and choosing sales metrics and performance indicators. This applies to the various kinds of analytics that sales organizations need. For example, our research finds that analytics is a priority for sales compensation management, where it is the top technology trend in 84 percent of organizations, and for sales forecasting (in 79% of organizations).

At this level of complexity sales organizations cannot continue to make do with outmoded tools. While spreadsheets are comfortable and familiar, when used for collaborative enterprise tasks they fall short in many areas such as lacking control of calculations and introducing inconsistent or erroneous data. Our research in sales compensation management finds that those that use them universally for this purpose are not satisfied with their analytics tools more often (in more than two-thirds of organizations) than those that use more capable tools.

A new generation of technologies offers more powerful and flexible sales analytics. Big data systems for processing and storing data have evolved quickly, making it possible for sales organizations to extract insights from masses of data for practical purposes. For example, visual discovery can present data in quickly graspable forms, and simplifying the presentation of key sales indicators and metrics in dashboards can put necessary information at the fingertips of nontechnical executives and managers. Advances in mobile technology enable access to analytics from smartphones and tablets, helping users on the go decide what to do next. Making sales applications and data available through cloud computing also facilitates access to and use of sales analytics. In addition collaboration enables sales teams to communicate and coordinate operations and managers and sales reps to plan more effectively. And predictive analytics enables users to look forward to anticipate trends and plan ahead rather than merely react.

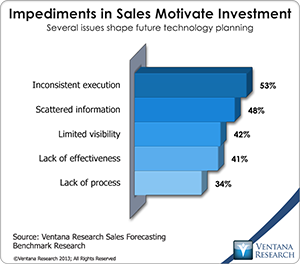

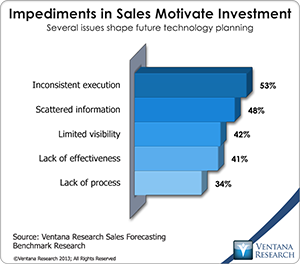

Analyzing these advances and their impacts on sales organizations now and in the near future, we have released new benchmark research on the next generation of sales analytics. It examines the use of and intentions for analytics and metrics involved in sales-related activities. It uses the Ventana Research Performance Index Model® to assess the productivity and performance of organizations by size and industry. A major aim of this research is to provide understanding of the need for and potential of advanced tools to help set a business case for investing in sales analytics. It assesses the impacts of these next-generation technologies in facilitating faster, easier and broader use of sales analytics. It follows up on previous research that shows that inconsistent execution and scattered information continue to motivate investment in about half of sales organizations and explores how advanced analytics can help remedy these issues.

Our mission in this new research is to uncover the best  practices companies use in measuring the performance of sales-related activities, the challenges they face and how they intend to improve their situations in the coming years. Sales analytics is a required component for any successful use of SFA to applications and activities individually or as part of sales performance management. It examines in detail issues in collecting data from a diverse set of sources that are critical for creating and maintaining useful sales metrics and indicators. It explores how data sources are reconciled through data preparation and then analyzed to produce the information sales people require to support decisions that impact their bottom line, market share and other aspects of their strategic objectives. Increasing the accuracy, confidence and timeliness of sales analytics is critical to every activity in sales, and those without a dedicated approach designed to assist sales will find themselves at a disadvantage. Sales analytics is a key resource for sales organizations facing today’s unprecedented challenges, as I recently outlined in our Sales Research Agenda for 2015. If you are responsible for sales activities or systems and want to see where the present and the future lie, please consult our research on the next generation of sales analytics.

practices companies use in measuring the performance of sales-related activities, the challenges they face and how they intend to improve their situations in the coming years. Sales analytics is a required component for any successful use of SFA to applications and activities individually or as part of sales performance management. It examines in detail issues in collecting data from a diverse set of sources that are critical for creating and maintaining useful sales metrics and indicators. It explores how data sources are reconciled through data preparation and then analyzed to produce the information sales people require to support decisions that impact their bottom line, market share and other aspects of their strategic objectives. Increasing the accuracy, confidence and timeliness of sales analytics is critical to every activity in sales, and those without a dedicated approach designed to assist sales will find themselves at a disadvantage. Sales analytics is a key resource for sales organizations facing today’s unprecedented challenges, as I recently outlined in our Sales Research Agenda for 2015. If you are responsible for sales activities or systems and want to see where the present and the future lie, please consult our research on the next generation of sales analytics.

Regards,

Mark

CEO and Chief Research Officer

It can help sales organizations reach quotas, forecast more accurately and make better decisions about activities and strategy. However, selecting the right tools for analytics can be difficult. People charged with identifying those tools often don’t understand the specific needs of sales groups or the full scope of evaluation criteria required for successful deployment and use.

It can help sales organizations reach quotas, forecast more accurately and make better decisions about activities and strategy. However, selecting the right tools for analytics can be difficult. People charged with identifying those tools often don’t understand the specific needs of sales groups or the full scope of evaluation criteria required for successful deployment and use.