We have just released our 2012 Value Index for Sales Performance Management (SPM), in which we evaluate the competency and maturity of vendors and products. Our firm has been  researching this software category for many years, and our latest benchmark research in sales performance management found many areas for improvement among sales applications in a field where many sales organizations still use outdated or insufficient applications to manage revenue generation and customer relationships.

researching this software category for many years, and our latest benchmark research in sales performance management found many areas for improvement among sales applications in a field where many sales organizations still use outdated or insufficient applications to manage revenue generation and customer relationships.

I am excited to bring this research to market again this year. No other research firm performs this level of analysis or follows it up on a regular basis. The Ventana Research methodology utilizes a request for proposal and assessment approach, and each value index takes six months to complete; unlike other analyst firms, we look at the product details that have the most importance in successful adoption and use. In the process we identify best and worst practices that further refine how we assess technology vendors in each category.

Our Value Index analysis for Sales Performance Management looks at the complete range of applications for sales organizations, including forecasting, coaching, compensation, incentives, quota and territory management and other key areas. This year it also examines the emerging needs for mobility, collaboration and analytics. We examine role-based requirements for a sales organization, from management, managers and operations to the account and sales representatives. We also look at the need for integration with other applications and processes. We individually assess and score the key product areas of usability, reliability, manageability, adaptability and capability, and also the customer assurance areas of validation and TCO/ROI.

A lot has changed among SPM suppliers since our last Value Index. For instance, Oracle has made multiple releases of Fusion CRM for Sales. Its applications are now rated Hot and rival those of salesforce.com; as well Oracle has many applications that salesforce lacks. For the first time we assessed SAP Sales OnDemand; its new focus and the updates to this cloud-based application have advanced it significantly. Xactly continues to release  applications that are usable, manageable and adaptable to an organization’s sales processes. Microsoft has made significant strides with its applications, which now can be accessed on mobile platforms such as Apple iOS and Android. These are just a few examples of the advances in applications for sales that go well beyond the traditional sales force automation of the past.

applications that are usable, manageable and adaptable to an organization’s sales processes. Microsoft has made significant strides with its applications, which now can be accessed on mobile platforms such as Apple iOS and Android. These are just a few examples of the advances in applications for sales that go well beyond the traditional sales force automation of the past.

While many vendors use the sales performance management moniker to describe their application suites or capabilities, some are just beginning to address the broad scope of needs across all sales processes. We do not assess in the SPM context vendors that provide only sales force automation applications, which really just track accounts, contacts and opportunities; that is only one portion of what sales organizations need to be efficient and effective. The SPM category is maturing rapidly, with new applications and capabilities that often available for rent in the cloud by organizations that prefer that approach to buying and installing software.

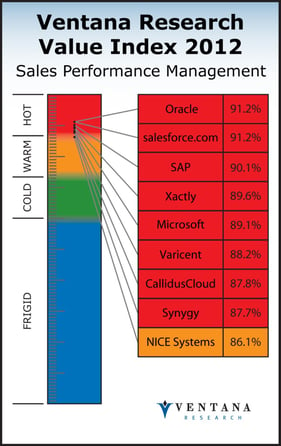

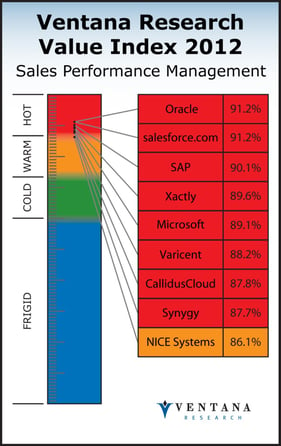

Our Value Index methodology assesses vendors across the seven categories noted above, each weighted according to its priority to buyers, and sums the results to 100 percent for scoring purposes. We placed a heavier emphasis this year on usability and manageability, which organizations indicated in our benchmark research are their highest priorities. You can read the details on our methodology and process in the full Sales Performance Management Value Index 2012 report.

Our analysis this year found eight vendors that provide robust offerings and deserve to be rated Hot, which is the highest value level and demonstrates maturity of offerings. Oracle and salesforce.com rank at the top, followed by SAP, Xactly, Microsoft, Varicent, CallidusCloud and Synygy. We note in our analysis that Microsoft and Oracle showed rapid product advancements, and their focus on usability, manageability and adaptability helped raise them in the ratings from last year. Oracle is the only vendor ranked Hot in the Capability evaluation, which is a thorough examination of all of the features needed for sales performance management. Salesforce.com has its work cut out to keep pace and maintain its leadership position in the face of fierce competition from the other vendors listed here.

We take pride in our Value Index, and we believe it is cool to be a Hot vendor. Unlike us, IT-focused analyst firms that do not research or advise sales organizations have a limited view focused on SFA or sales compensation and have created more confusion than clarity. The competitive market for these applications comprises a mature set of applications and capabilities across the roles and responsibilities of sales. Congratulations to the vendors that stood up to our detailed assessment processes and granular analysis, which represent how organizations assess and select vendors. If you want further information, please download the executive summary. We look forward to offering continued guidance to buyers on this critical application category for sales and operations professionals who need to have the most productive and result-oriented sales organizations.

Regards,

Mark Smith

CEO & Chief Research Officer